Princo sets three performance objectives for itself. Its first objective is to produce high absolute returns, sufficient to support the Endowment’s spending goals while preserving purchasing power. Second, we strive to generate returns that surpass those of a collection of market indices. Finally, we judge our performance relative to the investment results of other endowments, with the aim of having our long-term results place in the top quartile.

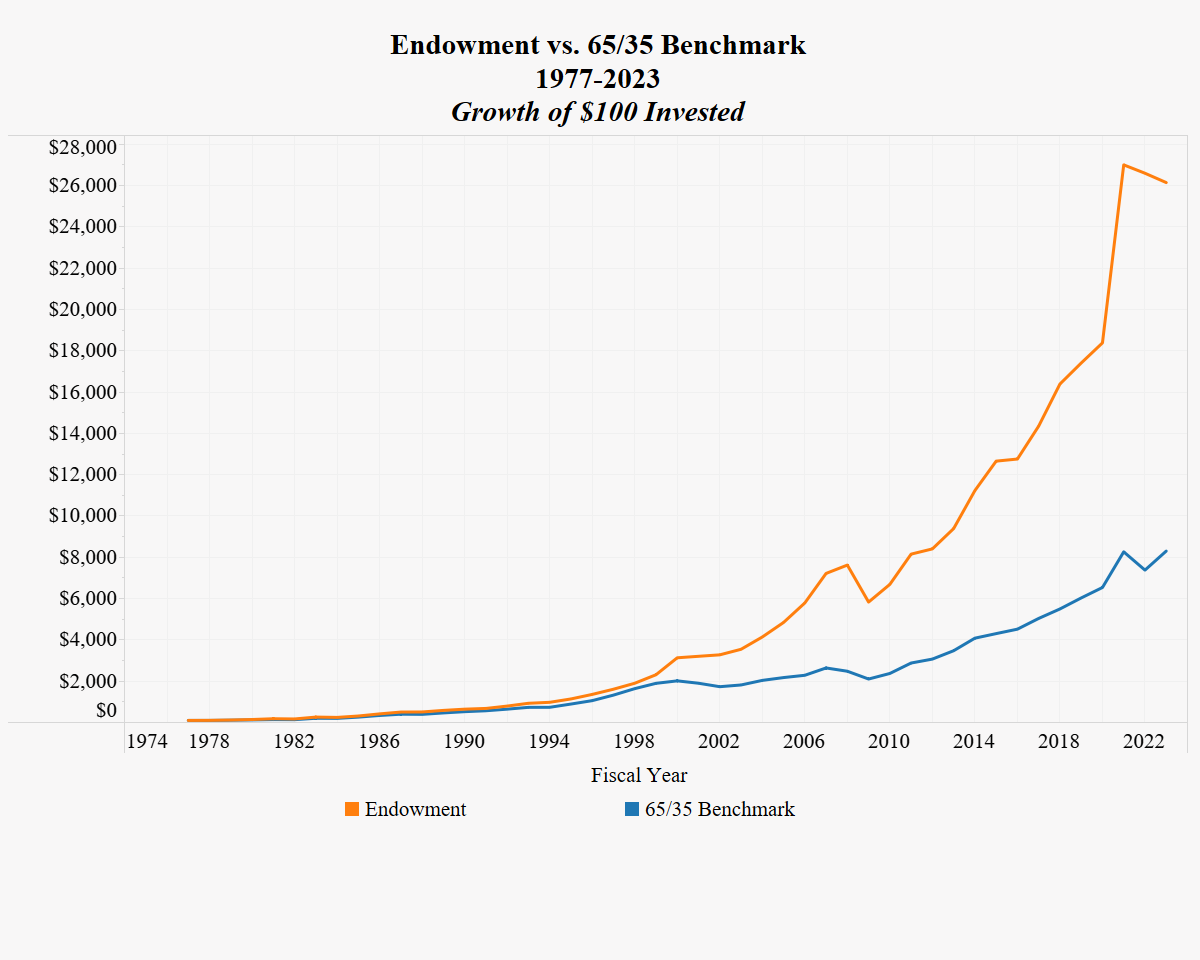

The graph below depicts the Endowment’s performance since 1977, when Princeton began hiring external managers. Also shown is a 65/35 blend of the S&P 500 and the Barclays Capital U.S. Government/Credit Bond Index. Over this period, the Endowment’s investments have earned a compound annualized return of 12.9%. On an absolute basis, this has fulfilled the University’s spending needs and added real purchasing power to the Endowment. On a relative basis, performance has also been very good, as an investment in the 65/35 benchmark would have compounded at 10.1% annually. Over the same period, the Endowment’s return ranks in the top percentile of institutional investors.

Source (65/35 Benchmark components): Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.