The Endowment’s mission necessitates a high return objective, which Princo can achieve over the long term only through an aggressive, equity-biased approach.

OVERVIEW

The purpose of the Endowment is to provide steady support for the University’s current and future operating needs, while preserving real value for future generations. This mission requires an expected return that exceeds the sum of the annual rate of spending and University inflation. This mission suggests that Princo must seek long-term returns above 10% per year, which financial theory and empirical evidence indicate can only be achieved through an aggressive, equity-biased approach.

Princo partners with best-in-class investment management firms across the globe and in diverse asset categories. Much of Princo’s success reflects its ability to select and gain access to top-tier managers, as well as engage with them constructively. This entails continuous, vigorous, yet cooperative dialogue, through which Princo seeks to encourage full utilization not only of manager skill but also of the Endowment’s natural advantages. Indeed, our strong partnership with managers has led to additional value creation.

Key among Princo’s advantages is the Endowment’s perpetual time horizon and relatively low spending requirements, which enable the fund to tolerate above-average volatility and below-average liquidity. Other advantages include the Endowment’s size, the University’s dedicated alumni base, and the reputations of both the University and Princo. The Endowment’s asset base is large enough to cost-effectively support the efforts needed to find highly attractive opportunities that often occur far from the beaten path. However, it is not so great as to prevent niche opportunities from having a meaningful impact. A vast network of alumni and University friends creates an informational advantage, while the collective skills and experience of Princo Directors and staff create an edge in judgement. Finally, the reputations of the University and Princo help the Endowment gain access to the very best investment firms, often even when they are turning other clients away.

ASSET ALLOCATION

A critically important element of Princo’s investment approach is our non-traditional asset allocation.

Asset allocation involves determining what share of the portfolio should be invested in various broad categories of investments. The decisions aim to balance the relative merits of equities versus fixed income, domestic versus foreign investments, and publicly-traded versus private assets.

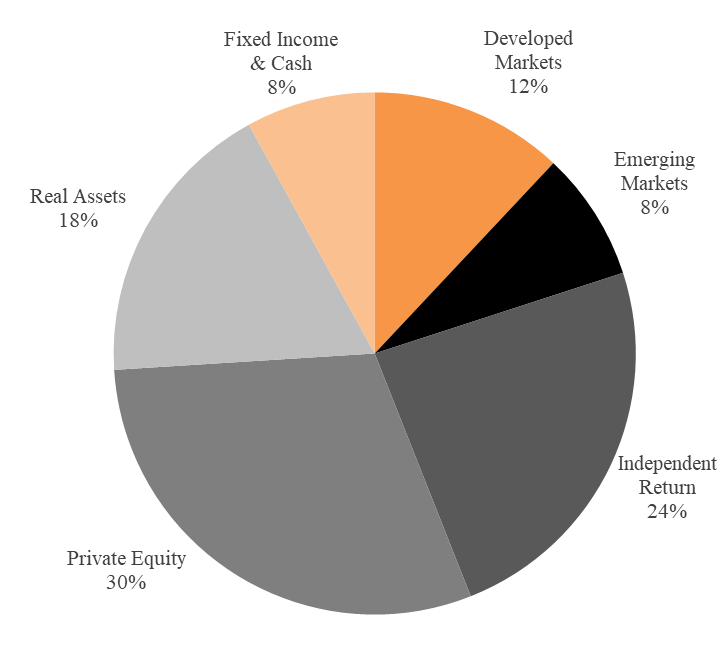

The Endowment’s Policy Portfolio describes Princo’s long-term, steady-state asset allocation targets in “normal” market conditions, and a range of weightings within which exposures can be adjusted in response to mid-term opportunities arising from significant market disequilibria or to other unusual circumstances. The figure below depicts the Policy Portfolio targets.

Clearly evident in the chart is Princo’s bias towards equities—92% of the portfolio is allocated towards them. Also striking is the relatively small portion allocated to U.S. equities. Only 12% of the portfolio is dedicated to the Developed Markets category, with approximately 60% of the category targeted to U.S. equities. Large portions of the portfolio are allocated to other high-return categories. Independent Return, Private Equity, and Real Assets bear further description. Independent Return is broadly defined as consisting of investment vehicles that seek high absolute returns that are independent of broad market trends. One distinguishing characteristic of managers in this category is that many attempt to exploit opportunities in overvalued assets, via “short” positions that would benefit from price declines, as well as pursue more conventional “long” positions that represent bets on price appreciation. Also included in the category are managers that focus on event-driven investments, such as those in companies going through mergers, acquisitions, or bankruptcy reorganizations. Private Equity and Real Assets include investments in private companies, venture capital, real estate, and natural resources. These areas can offer highly attractive opportunities for skilled, patient investors. One compelling feature of these categories is the possibility of increasing the value of underlying assets through operational and structural improvements.

Princo diversifies into non-traditional asset categories for several reasons. Most importantly, we seek a return premium. Compared to the U.S. stock market, each of these areas offers the potential to improve the Endowment’s expected long-term, compound returns. In each of these arenas, Princeton has competitive advantages that make superior returns particularly likely. A broader opportunity set means that the portfolio should be capable of producing high returns more often and in a greater variety of environments. Finally, the multi-asset class approach offers diversification benefits that help control risk.

More information about Princo’s investment strategy can be found in the Report on Investments within the Report of the Treasurer.